- السبت ٠٤ فبراير ٢٠٢٥

- The best projects

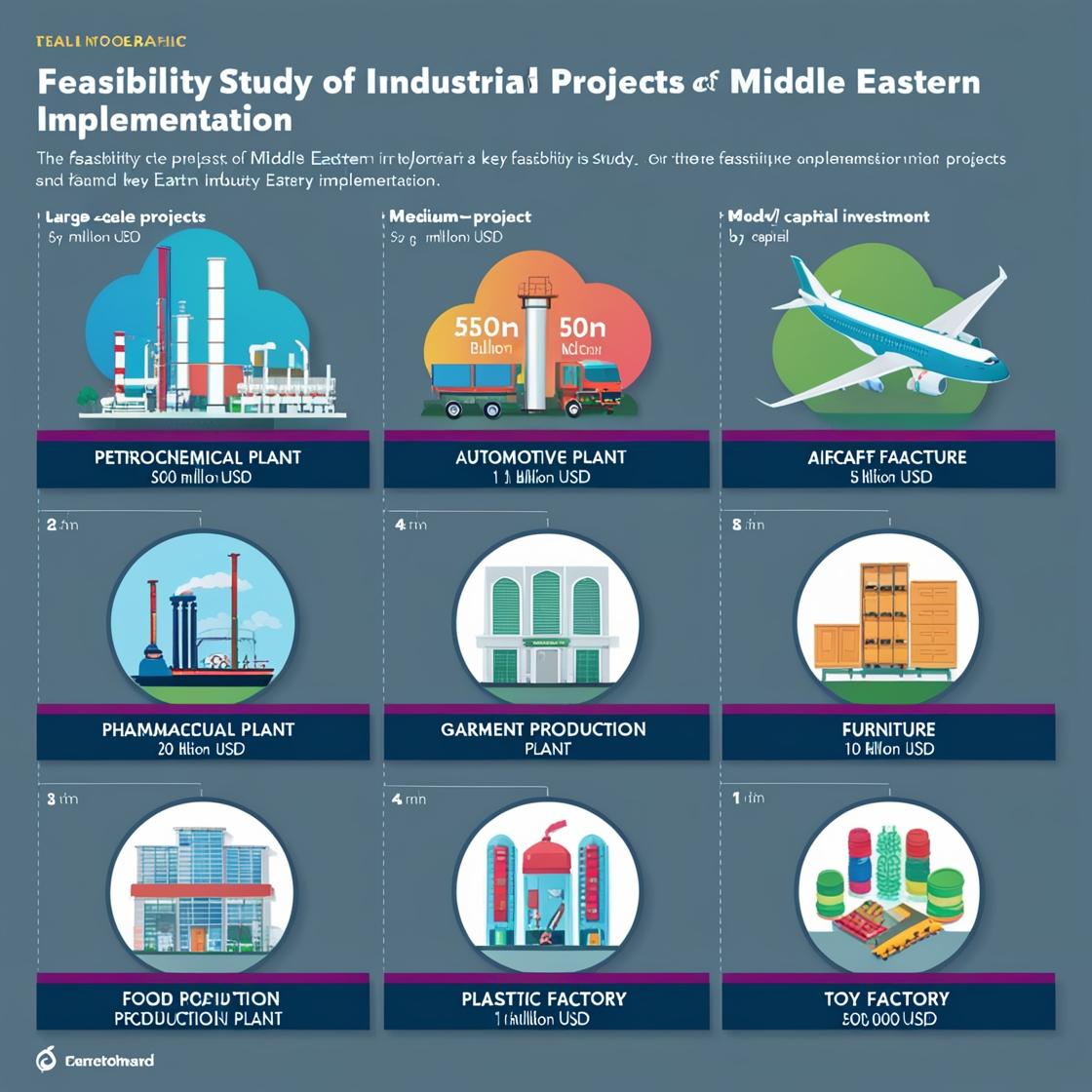

Investor Guide: Invest in Saudi Arabia

Q: What is the concept of investing in Saudi Arabia?

- A: Investing in Saudi Arabia involves injecting funds and resources to develop commercial or industrial projects with the aim of achieving financial returns. This process is supported by policies from the Saudi Investment Ministry [Saudi Investment Guide].

- Q: How can a foreign investor begin investing in Saudi Arabia?

A: A foreign investor should start by visiting the Saudi Investment Ministry website to learn about the requirements and procedures (you can refer to Googan’s services), and then proceed to apply for the necessary license. - Q: What are the essential documents required for investing in Saudi Arabia?

A: Required documents include a passport, proof of financial capability, a business plan, a feasibility study, and other documents as specified by the government authorities [Saudi Investment Guide]. - Q: How does Googan assist in preparing a feasibility study for my project?

A: Googan prepares a comprehensive feasibility study that includes market analysis, cost estimation, financial performance indicators, and development strategies tailored precisely to the project’s needs. - Q: Does Googan provide document translation services?

A: Yes, Googan has a dedicated translation department that provides high-quality document translation services to meet the needs of foreign investors. - Q: How do I conduct market research for my product in Saudi Arabia?

A: Start by collecting data about the local market, analyzing the demographic composition, assessing competition, and studying purchasing trends. You can rely on Googan’s services to prepare an integrated feasibility study. - Q: Do my foreign operations align with the Saudi environment?

A: That depends on the market study and environmental analysis of your project; Googan can help you assess whether your business is compatible with the Saudi environment and local market standards. - Q: What does Googan do for me as a foreign investor?

A: Googan provides detailed feasibility study services that include financial, marketing, and technical analyses, along with the necessary consulting to facilitate entry into the Saudi market. - Q: How do I choose the best location for my company in Saudi Arabia?

A: The choice of location depends on factors such as population density, infrastructure, accessibility, and competition. You can use specialized market studies provided by Googan. - Q: Is the Saudi Investment Ministry complicated to deal with?

A: The ministry is very flexible and easy to deal with, providing a comprehensive guide to simplify the process; specialized consultants are also available for support. - Q: Does Googan prepare a feasibility study for my project?

A: Yes, Googan offers detailed feasibility study services that are tailored to the nature and budget of your project while addressing the requirements of the Saudi market. - Q: How can my investment documents be translated?

A: Googan provides document translation services through a dedicated department that ensures precise and professional translation to meet the requirements of government authorities and investors. - Q: How does Googan meet my investment needs in Saudi Arabia?

A: Googan offers integrated consulting and feasibility study services, accurate market analysis, and technical support to ensure that your project complies with the Saudi environment and provides high success potential. - Q: What are the main benefits of conducting a feasibility study before investing?

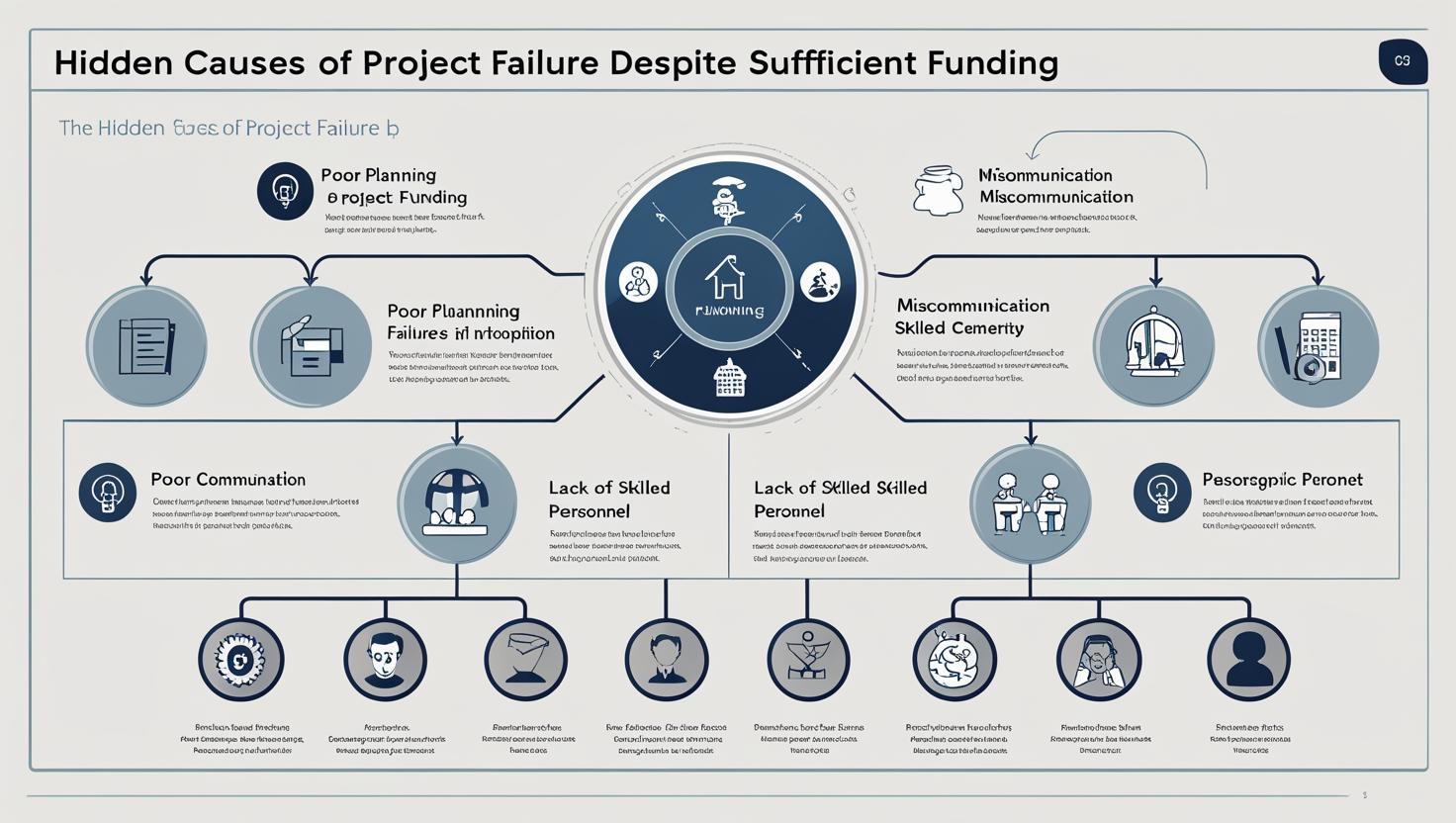

A: A feasibility study helps identify risks and opportunities, estimate costs and revenues, and ensures that investment decisions are based on accurate data. - Q: Does a feasibility study require regular updates?

A: Yes, it is advisable to update the feasibility study periodically to reflect market and economic changes in Saudi Arabia. - Q: What are the main challenges of investing in Saudi Arabia?

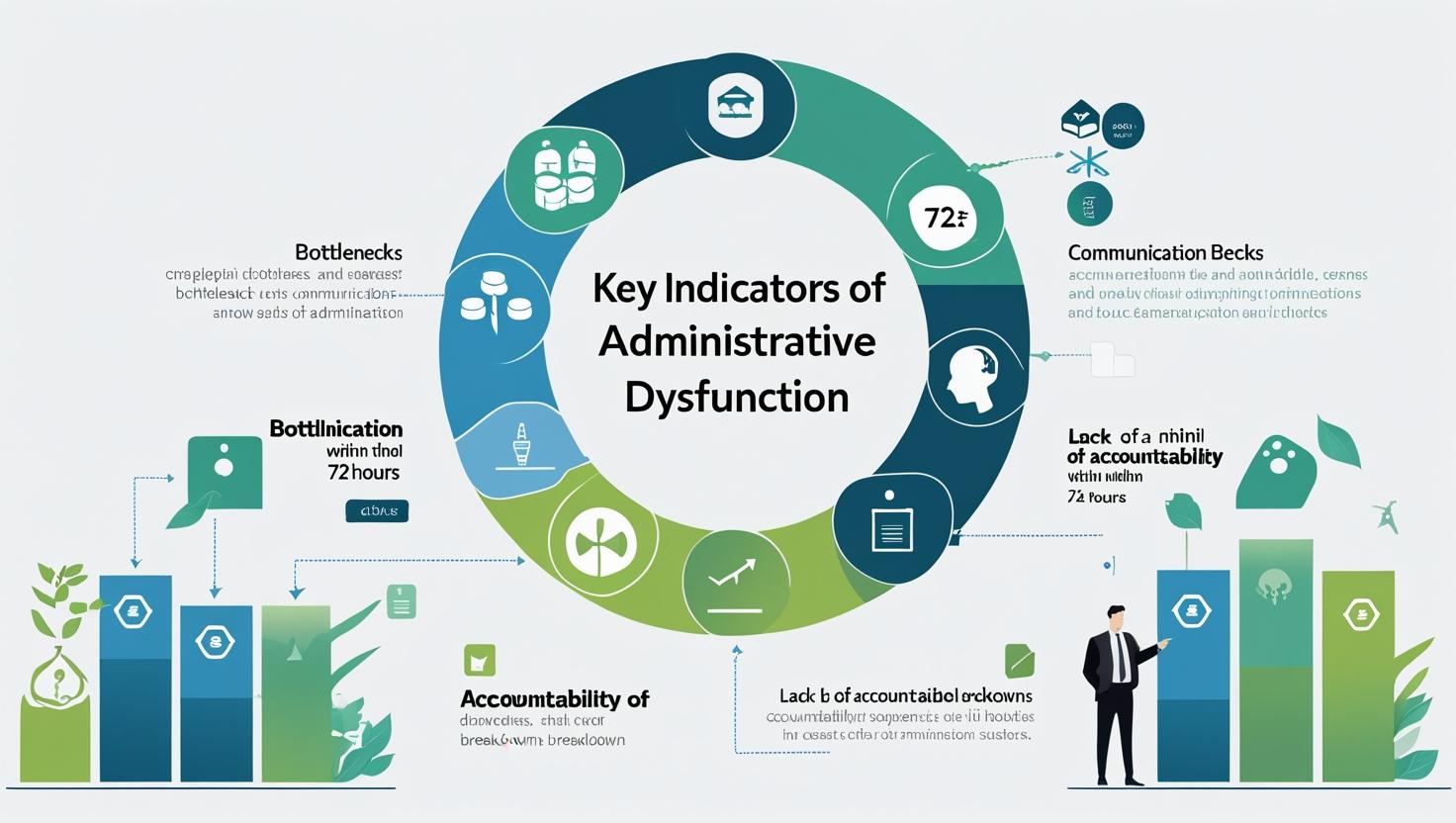

A: Challenges may include procedural complexities, market competition, cultural differences, and the need for accurate market research to identify opportunities and threats. - Q: How can I improve the visibility of my investment project in the Saudi market?

A: By preparing a comprehensive feasibility study, selecting the right location, implementing effective marketing strategies, and adhering to government standards. - Q: What role do legal consultations play in the investment process?

A: Legal consultations ensure that the project complies with Saudi laws and regulations, preventing future legal issues. - Q: How do I ensure my business complies with Saudi regulations?

A: Review the regulations published by the Saudi Investment Ministry and other regulatory bodies; you can also seek assistance from Googan’s services. - Q: What is the importance of financial evaluation in a feasibility study?

A: Financial evaluation is the cornerstone of a feasibility study, as it helps determine the project’s profitability and forecast future returns. - Q: How is the Net Present Value (NPV) calculated?

A: NPV is calculated by discounting the expected future cash flows back to their present value using an appropriate discount rate, indicating the project's anticipated profitability. - Q: What is the Internal Rate of Return (IRR)?

A: IRR is the rate at which the net present value of the expected cash flows equals zero; it is used to evaluate the attractiveness of the investment. - Q: What data is needed for an accurate feasibility study?

A: Data includes market analysis, cost estimates, revenue forecasts, demographic data, and competitive analysis, along with financial indicators such as NPV and IRR. - Q: How do I conduct a market study for a project in Saudi Arabia?

A: By collecting demographic data, analyzing consumer behavior, evaluating competition, and studying market trends through reports from the Saudi Investment Ministry and the Saudi Investment Guide. - Q: Does Googan provide market analysis for the Saudi market?

A: Yes, Googan offers comprehensive feasibility study services that include detailed market analysis for the Saudi market, helping investors understand the local environment. - Q: How do I choose the best location for my company in Saudi Arabia?

A: It is recommended to conduct a demographic analysis and evaluate potential sites using data from the Saudi Investment Ministry, with detailed reports available from Googan. - Q: What role does infrastructure play in selecting an investment location?

A: Infrastructure is a key factor that influences project success by affecting customer access and logistical services; this is confirmed in market studies provided by Googan. - Q: Is it necessary to work with local consultants only?

A: It is best to combine local and international expertise; local consultants help understand the Saudi market in detail while international firms like Googan offer comprehensive analyses based on globally recognized scientific standards. - Q: What challenges might foreign investors face in Saudi Arabia?

A: Challenges include understanding the regulatory environment, adapting to local culture, and obtaining accurate market information; Googan can help overcome these challenges by providing detailed feasibility studies. - Q: How can these challenges be overcome?

A: By relying on comprehensive feasibility studies (such as those offered by Googan) and collaborating with local experts and market specialists. - Q: What are the competitive advantages of investing in Saudi Arabia?

A: Saudi Arabia offers significant investment opportunities through its national development vision, investment incentives, modern infrastructure, and increasing political and economic stability [Saudi Investment Guide]. - Q: How does Saudi Vision 2030 impact investments?

A: Saudi Vision 2030 enhances investment opportunities across various sectors by promoting economic diversification and providing incentives and guarantees to investors. - Q: What sectors are promising for foreign investors in Saudi Arabia?

A: Promising sectors include renewable energy, technology, manufacturing, tourism, healthcare, as well as retail and services. - Q: How does Googan improve investment opportunities in Saudi Arabia?

A: Googan provides comprehensive reports and feasibility studies that help investors accurately assess projects, identify risks and opportunities, and make data-driven decisions. - Q: Does Googan offer detailed analysis of the regulatory environment in Saudi Arabia?

A: Yes, Googan’s services include an analysis of the regulatory and legal environment, reviewing the requirements set by government authorities. - Q: How can I ensure my product aligns with the Saudi environment?

A: By studying local environmental and market factors in detail through analyses provided by Googan in collaboration with local authorities. - Q: What are the key factors to consider in a market study for Saudi Arabia?

A: Key factors include demographic composition, consumer behavior, local competition, and economic trends—all analyzed in detail through a comprehensive feasibility study. - Q: Does Googan prioritize the technical study aspect?

A: Yes, the technical study is an essential part of Googan’s feasibility study, evaluating location selection, process design, raw material requirements, and operating costs. - Q: How do I prepare a technical study for a recycling plant?

A: A technical study should begin by determining the plant’s location, designing production lines, estimating raw material needs, and calculating energy and labor costs. Googan’s reports assist in preparing this study accurately. - Q: What are the basic steps for conducting a market study for a project in Saudi Arabia?

A: The steps include data collection, market demand and supply analysis, competition study, and identifying strengths and weaknesses, using advanced analytical tools provided by Googan. - Q: Does the technical study integrate with the financial study in a feasibility study?

A: Yes, the technical and financial studies are integrated to provide a comprehensive view of the project’s viability, thereby reducing risks and ensuring success. - Q: How can I ensure the accuracy of the data used in the study?

A: It is essential to use reliable sources such as the Saudi Investment Ministry website, the Saudi Investment Guide, and Googan’s verified studies from reputable American scientific journals. - Q: Does Googan provide updated reports for investors?

A: Yes, Googan issues periodic updates to reflect market and economic changes in Saudi Arabia, helping investors make informed decisions. - Q: How can the feasibility study be updated after the project starts?

A: The study is updated using new data and actual project performance analyses, along with periodic reviews of market and regulatory factors in collaboration with Googan’s experts. - Q: What is the expected timeline for preparing a feasibility study for an investment project?

A: Typically, the study takes between 4 to 8 weeks depending on the project’s complexity and the volume of data required, with Googan committed to meeting the agreed deadlines. - Q: Do global economic conditions affect investments in Saudi Arabia?

A: Yes, global economic factors do impact the Saudi market; however, government policies and Saudi Vision 2030 help create a stable and attractive investment environment. - Q: How does the Saudi Investment Guide help direct investors?

A: The Saudi Investment Guide provides comprehensive instructions on procedures, regulations, and investment opportunities in Saudi Arabia, making it easier for foreign investors to understand the local environment. - Q: What are the main challenges foreign investors face in Saudi Arabia?

A: Challenges include understanding the legal and regulatory framework, adapting to local culture, and obtaining accurate market information; Googan’s detailed feasibility studies help overcome these challenges. - Q: How can I ensure that the study meets investor expectations?

A: The study should be comprehensive, detailed, and based on up-to-date data and precise financial indicators, which increases investor confidence in the project’s viability. - Q: Must I work exclusively with local consultants?

A: It is best to combine local and international expertise; local consultants offer deep insights into the Saudi market, while international firms like Googan provide comprehensive analyses based on globally accepted scientific standards. - Q: How do I benefit from Googan’s feasibility study services?

A: Googan offers integrated services that include financial, marketing, and technical analyses along with decision support, helping you identify opportunities and risks accurately. - Q: What is the importance of using peer-reviewed scientific reports in the study?

A: Peer-reviewed reports ensure the reliability and accuracy of the study, as the analysis is based on recent data and research from reputable American scientific journals [1][2][3][4]. - Q: How is the Internal Rate of Return (IRR) evaluated?

A: IRR is calculated using the expected cash flows of the project and indicates the project’s profitability relative to its investment costs. - Q: What are the key financial performance indicators to analyze?

A: Key indicators include Net Present Value (NPV), Internal Rate of Return (IRR), payback period, and profit-to-cost ratio; these are standard metrics used in Googan’s feasibility study. - Q: How can fixed and variable costs be estimated?

A: Fixed and variable costs are estimated by gathering detailed operational expenditure data and analyzing them using established financial models—a fundamental step in Googan’s feasibility study. - Q: Does Googan offer post-study consulting services?

A: Yes, Googan provides ongoing consulting services to help investors implement the study and monitor performance over time. - Q: What are the basic steps for conducting a comprehensive feasibility study in Saudi Arabia?

A: The steps include data collection, market analysis, cost evaluation, financial analysis, competition study, developing a marketing strategy, and periodic updates of the study. - Q: Should the study include legal aspects?

A: Yes, the study must include legal and regulatory aspects to ensure the project complies with local laws—an essential component of Googan’s feasibility study. - Q: How does site selection affect project success?

A: Site selection directly affects customer access, operating costs, and competitiveness; it should be based on accurate data and comprehensive analysis as provided by Googan. - Q: Can I use local market analysis tools?

A: Yes, it is advisable to use local market analysis tools alongside international data to ensure accuracy in the Saudi environment [Saudi Investment Guide]. - Q: What is the importance of demographic research in the study?

A: Demographic research helps determine the target audience, income levels, and purchasing behavior, which contributes to better marketing strategies and pricing decisions. - Q: How do I ensure that my business aligns with Saudi culture?

A: Studying local cultural, social, and market factors in detail—using reports from Googan and the Saudi Investment Ministry—ensures that your business aligns with the Saudi culture. - Q: What role does technology play in enhancing a feasibility study?

A: Technology aids in data collection, precise analysis, and the presentation of detailed reports, thereby supporting investment decisions on a solid scientific basis. - Q: How can I obtain up-to-date market data for Saudi Arabia?

A: Up-to-date data can be obtained from the Saudi Investment Ministry reports, the Saudi Investment Guide, and specialized analytical platforms like those provided by Googan. - Q: Should the study be updated regularly?

A: Yes, it is recommended to update the study periodically to reflect changes in market conditions and economic factors. - Q: What criteria does the study use to evaluate competition?

A: The study evaluates competition based on the size of competing companies, their marketing strategies, pricing, service quality, and their strengths and weaknesses. - Q: How should economic changes be incorporated into the study?

A: The study should include multiple scenarios for economic changes and analyze their impact on the project using advanced financial models. - Q: Does Googan provide practical examples of successful feasibility studies?

A: Yes, Googan offers real case studies of successful projects in both the Saudi and international markets to help investors make informed decisions. - Q: How can I use the study to convince investors?

A: A comprehensive study that covers all financial, technical, and market aspects of the project builds investor confidence by demonstrating the project’s feasibility based on reliable data. - Q: Is risk analysis included in the study?

A: Yes, risk analysis is an integral part of Googan’s feasibility study, where potential risks are identified and strategies to mitigate them are outlined. - Q: How do I handle unforeseen variables?

A: Contingency plans and alternative scenarios are prepared to manage unforeseen variables, ensuring project continuity and minimizing financial risks. - Q: What benefits can a foreign investor gain?

A: A foreign investor gains access to a detailed study that outlines the project’s financial and technical feasibility, aiding in data-driven investment decisions. - Q: How does Googan help determine the project’s feasibility?

A: Googan provides comprehensive reports based on advanced data analytics covering financial, technical, and market aspects, helping to accurately assess project feasibility. - Q: Can I consult Googan’s experts for technical guidance?

A: Yes, Googan offers technical and marketing consultations to help investors refine the study and guide them professionally. - Q: How do I address local market challenges?

A: By conducting detailed market research, regularly updating the study with advanced analytical tools, and leveraging government data and Googan’s reports. - Q: Is it possible to merge the technical study with the market study?

A: Absolutely; merging the technical and market studies provides a comprehensive view of the project, illustrating how production processes integrate with market needs. - Q: What is the importance of using a scientific methodology in the study?

A: A scientific methodology ensures data accuracy and robust analysis, enhancing the credibility of the study and enabling investment decisions based on solid foundations [1][2]. - Q: Is the study necessary before applying for licenses?

A: Yes, preparing a feasibility study is a critical step before applying for the necessary licenses from government authorities. - Q: How can I secure government support?

A: By ensuring full compliance with all the standards and requirements set by government agencies and consulting experts like Googan to update the study according to changes. - Q: Is the study useful in attracting business partners?

A: Yes, the study provides a clear vision and economic viability, making the project more attractive to potential business partners and investors. - Q: How is the project’s feasibility evaluated from a financial perspective?

A: Feasibility is evaluated by calculating key financial indicators such as NPV and IRR, and analyzing expected cash flows—standard metrics used in Googan’s feasibility study. - Q: What tools are used in preparing the study?

A: Tools include financial data analysis software, forecasting models, market research instruments, and online platforms like Googan for data aggregation. - Q: How do I ensure the accuracy of sales forecasts?

A: By collecting precise data on the local market and using advanced financial forecasting models, supported by expert consultation from Googan. - Q: Can I compare my feasibility study with those of other projects?

A: Yes, you can compare your study with similar case studies from commercial and industrial projects in the Saudi market to benchmark performance. - Q: What sources should I rely on for preparing the study?

A: The study should rely on reports from the Saudi Investment Ministry, the Saudi Investment Guide, and peer-reviewed articles from reputable journals such as Harvard Business Review and the Journal of Business Research. - Q: Can I get technical support from Googan?

A: Absolutely; Googan provides technical support and consulting to help investors tailor the study to local requirements. - Q: How do I ensure the study meets investor expectations?

A: The study must be comprehensive, detailed, and based on the latest data and accurate financial indicators, thereby increasing investor confidence in the project’s feasibility. - Q: Does the study include risk analysis?

A: Yes, risk analysis is a core component of Googan’s feasibility study, identifying potential risks and proposing strategies to mitigate them. - Q: How do I handle price changes in the Saudi market?

A: The study should incorporate financial forecasting models that are updated regularly to reflect market price changes. - Q: Does the study offer recommendations on marketing strategies?

A: Yes, the study includes a dedicated section for marketing strategies that outlines the best approaches to penetrate the market and attract customers. - Q: What is the importance of design and organization in the study?

A: A well-designed and organized study makes it easier for investors to understand the information and increases its credibility—an aspect that Googan emphasizes. - Q: How can I ensure the study meets international standards?

A: The study is prepared using internationally recognized methodologies, referencing scientific research from sources such as Harvard Business Review and the Journal of Small Business Management. - Q: Can I modify the study later if circumstances change?

A: Yes, it is advisable to update the study periodically to reflect changing economic and market conditions. - Q: How does the study help reduce investment risks?

A: By identifying potential risks and outlining strategies to mitigate them, the study reduces the likelihood of losses and enhances project stability. - Q: What are the basic steps to begin investing after the study?

A: Steps include obtaining the necessary licenses, selecting the appropriate location, executing the operational plan, and implementing effective marketing strategies. - Q: How should I handle government regulations?

A: You must thoroughly study the government regulations and comply with them; Googan’s experts can provide updates on any changes in laws and regulations. - Q: Does Googan provide post-study follow-up services?

A: Yes, Googan offers follow-up services and additional consultations to ensure the study is implemented effectively and the project meets its objectives. - Q: What distinguishes Googan’s feasibility study from others?

A: Googan’s feasibility study is distinguished by its integrated approach that combines financial, technical, and marketing analyses, using the latest data and peer-reviewed scientific references. This makes it a valuable resource for investors in Saudi Arabia and helps them make well-informed investment decisions.